Levi Strauss & Co. Stock Market Analysis .

Task At Hand

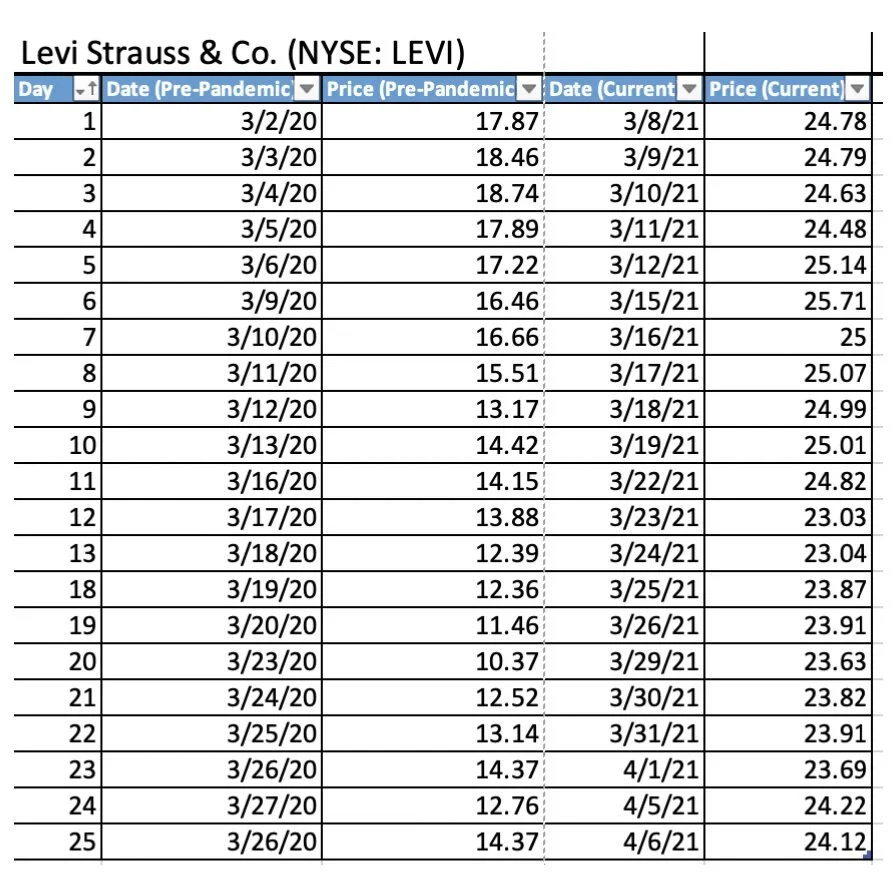

Tasked with tracking, recording, & analyzing Levi Strauss’s performance in the NYSE Stock Exchange during March 2021 to compare to their performance in the year prior (Pre-Pandemic 2020) as the economy shifted into a bear market. The 2020 Stock Exchange performance revealed a heavy dip in Quarter 2 and a steady decline in market prices as the losses began to outweigh the profits as 700 total jobs had to be removed, directly linked to the COVID-19 Pandemic. Tracked the quantitative market bearings as well as specific qualitative strategies such as increased customer engagement, I was able to anaylise the results between the two years.

Process

To analyze Levi’s finical performance in the stock exchange, I recorded the market summary daily, taking into account the specific revenue and net income and overall stock share. Additionally, I conducted daily market research on Levi’s current and past marketing strategies pertaining to their broader market reach by collaborating with Streetwear King, Angelo Baque to produce a vintage denim collection appealing to a younger customer base, focusing on brand to consumer relationships, shifting from in-store focus to E-commerce & Digital omni-channel prevalence, and implementing sustainability practices such as energy efficient trucks and utilizing natural fibers into their product assortment, nearly doubling stock prices from March 2020 - March 2021.

Read Project

Read Project

Impact

Monitoring Levi’s performance from a financial standpoint and marketing perspective was improved my knowledge on the correlation and relevancy of looking at a company performance from a qualitative and quantitative standpoint. Remaining present on current events, the economy, and other areas of the market place are vital as the zeitgeist effects fashion and company performance.